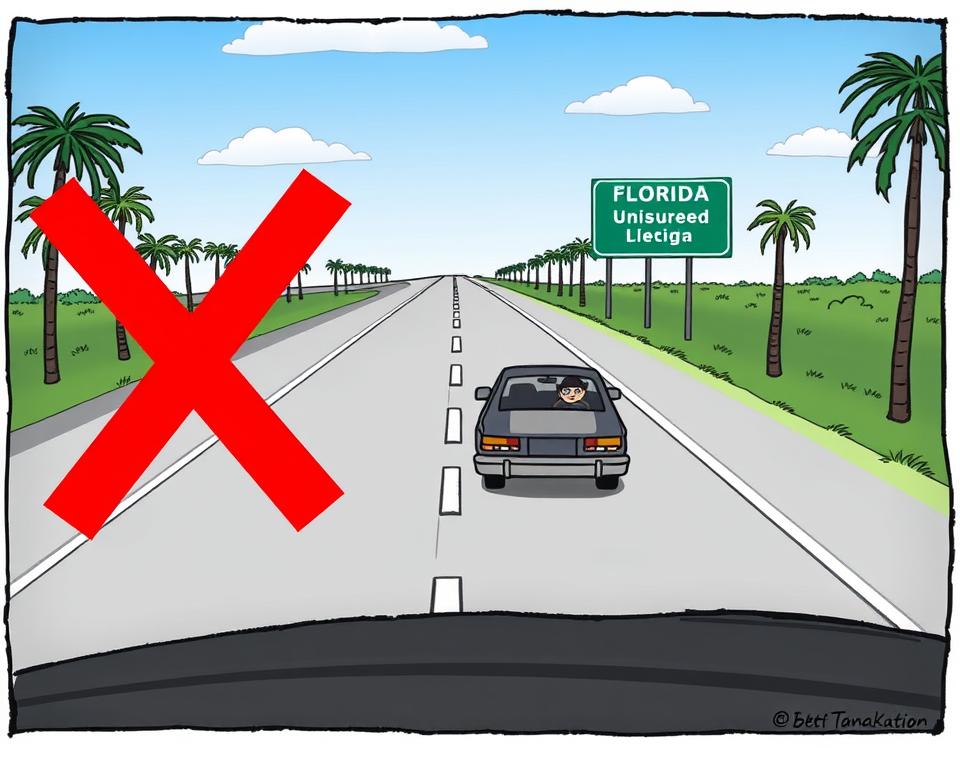

Discover the essentials of Uninsured Motorist coverage in Florida – your shield against costs from accidents with uninsured drivers.

Anúncios

Imagine driving down a sunny Florida road, feeling alive, when suddenly, an accident happens. You find out the other driver has no insurance. This is a scary situation, as about 20% of Florida drivers don’t have insurance. This fact is not just a number; it’s a risk to your financial safety.

Uninsured Motorist (UM) coverage is more than just a part of your car insurance. It’s your safety net in unexpected situations. Knowing about UM coverage in Florida can help you handle tough times better.

Key Takeaways

- Uninsured Motorist (UM) coverage protects you if you’re in an accident with an uninsured driver.

- Approximately 20% of drivers in Florida are uninsured.

- UM coverage is optional but essential for financial security.

- The state requires insurers to offer UM coverage, but acceptance is up to the driver.

- Understanding UM coverage can ease the stress during an accident.

Understanding Uninsured Motorist Coverage

It’s key for drivers to know about uninsured motorist coverage (UM insurance). This coverage helps when you’re in an accident with an uninsured driver. In Florida, where car insurance is a must, UM insurance is even more important.

UM coverage helps with two main things: injuries and damage to your car. If an uninsured driver hits you, you can use your UM insurance. This way, you won’t have to pay for medical bills, car repairs, or lost wages.

In Florida, drivers must have Personal Injury Protection (PIP) for certain costs, no matter who was at fault. UM insurance adds extra protection if you hit an uninsured driver. So, knowing about UM coverage is crucial for car accident protection in Florida.

Importance of Car Insurance Coverage in Florida

Car insurance is crucial for all drivers in Florida. It meets legal requirements and protects against financial risks from driving. Florida has a “no-fault” system, where each driver’s insurance covers medical claims, not matter who was at fault. This shows how vital car insurance is for drivers and their passengers.

More drivers without insurance are making the need for uninsured motorist coverage clear. Those without insurance face big financial risks. Having enough uninsured motorist coverage means you won’t have huge bills if hit by an uninsured driver. Florida law sets a minimum insurance level, but choosing higher limits, especially for uninsured motorist coverage, boosts your financial safety after an accident.

It’s key to know how different coverage levels work. Picking the right coverage helps manage your liability and protects your assets. Here’s a look at minimum and recommended coverage levels:

| Type of Coverage | Minimum Required Coverage | Recommended Coverage |

|---|---|---|

| Liability Coverage | $10,000 bodily injury per person | $100,000 bodily injury per person |

| Property Damage Liability | $10,000 per accident | $50,000 per accident |

| Uninsured Motorist Coverage | Not required | $50,000 per person / $100,000 per accident |

What to Do in a Hit and Run Accident

Being in a hit and run accident can be scary. But, it’s important to know what to do next. First, make sure you and others are safe. Call 911 right away for help.

After safety is confirmed, start documenting what happened. This is key for a good response to the accident.

Try to remember as much as you can about the car and the driver who left the scene. Look for:

- License plate number

- Make and model of the vehicle

- Color of the vehicle

- Description of the driver

Talking to witnesses can also help a lot. They might remember things you don’t. If you have Uninsured Motorist Coverage, think about filing a claim. This can help cover medical bills and car repairs if you don’t know who hit you.

Learn about Florida’s laws on hit and run accidents. These laws let victims get help from their insurance. This way, you won’t be left without support after an accident.

Types of Uninsured Motorist Coverage

In Florida, it’s key to know the different types of uninsured motorist coverage. These include bodily injury and property damage coverage. Understanding these can help protect you financially if you meet an uninsured driver.

Uninsured Motorist Bodily Injury Coverage

This coverage pays for medical bills from accidents with uninsured drivers. It’s very important because medical costs can add up fast. In Florida, it covers medical expenses, lost wages, and pain and suffering.

Uninsured Motorist Property Damage Coverage

This coverage helps if your car gets damaged in an accident with an uninsured driver. It pays for repairs or replacing your car and personal items. Having this coverage means your car is protected against unexpected damage.

How Underinsured Motorist Coverage Works

Underinsured motorist coverage is key for drivers facing accidents with those who don’t have enough insurance. If someone hits you and their insurance doesn’t cover all your costs, this coverage can help. It’s important to know how it works to stay safe on the road.

Difference Between Uninsured and Underinsured Motorist Coverage

It’s crucial to understand the difference between these coverages. Uninsured motorist coverage kicks in when a driver with no insurance causes an accident. Underinsured motorist coverage is for when the at-fault driver has some insurance but it’s not enough to cover your damages. Here’s a clear breakdown:

| Aspect | Uninsured Motorist Coverage | Underinsured Motorist Coverage |

|---|---|---|

| Definition | Covers damages caused by an uninsured driver. | Covers the gap when an at-fault driver’s insurance is insufficient. |

| Insurance Status of At-Fault Driver | None | Some, but inadequate |

| Claim Examples | Hit-and-run accidents or uninsured individuals. | Accident with a driver whose coverage limits are lower than your expenses. |

| Policy Limits | Full policy limit available. | Subject to underinsured limits set in your policy. |

Insurance Policy Limits for Uninsured Motorist Coverage

In Florida, there are no state-mandated limits for Uninsured Motorist Coverage. However, insurance companies must match these limits with the auto policy’s liability limits. It’s important for drivers to think about their financial situation when picking policy limits.

Commonly preferred limits often include:

- $10,000

- $25,000

- $50,000

Experts often suggest choosing higher limits for better protection in serious accidents. Knowing about these limits helps drivers understand their potential costs after a crash. The choices made affect the financial safety net after an accident.

Choosing the right insurance coverage and limits can reduce financial risks from car accidents. Drivers can make informed choices by understanding their policy limits. This ensures they have the right protection for their needs.

The Uninsured Motorist Claim Process

Filing an uninsured motorist claim is a step-by-step process. First, document the accident well. Collect police reports, medical records, and any evidence that supports your claim. This will be the core of your claim.

Next, report the incident to your insurance company right away. Telling them early is key to starting the claim process. After you file your claim, your insurance will look into it deeply. They check if your claim is valid using the evidence and your policy details.

Then, negotiations on the claim settlement happen. If the offer is less than you hoped for or if there are disagreements, getting legal advice is a good idea. Legal experts can help you in tough negotiations and make sure you get fair compensation for your injuries.

| Step | Description |

|---|---|

| 1. Document the Accident | Gather police reports, medical records, and evidence to support your claim. |

| 2. Report the Incident | Notify your insurance company as soon as possible to initiate your claim. |

| 3. Investigation | The insurance company will assess the validity of your claim through a detailed investigation. |

| 4. Negotiation | Enter negotiations regarding the claim settlement amount if applicable. |

| 5. Legal Consultation | If disputes arise, consider consulting legal experts for professional guidance. |

Cost of Uninsured Motorist Coverage in Florida

The cost of uninsured motorist coverage in Florida changes based on many coverage cost factors. These factors are key in setting how much drivers pay for insurance. Knowing them helps people make better choices when picking their policies.

Factors Influencing Uninsured Motorist Coverage Cost

Many things affect the cost of uninsured motorist coverage, especially in Florida. This state has unique driving conditions that change insurance rates. The main factors include:

- Age of the driver

- Driving experience and history

- Location of residence

- Credit score

- Previous insurance claims

- Chosen coverage limits

Young and less experienced drivers often pay more. Urban areas with heavy traffic have higher rates too. Insurance companies also look at credit scores and claim histories, which changes prices.

Compared to other insurance types, uninsured motorist coverage is usually cheaper. This makes it a good choice for many who want full protection against uninsured drivers. It’s smart for buyers to look at their options to find the best rates, considering how different coverage cost factors affect prices.

For expert advice, talk to experts in the field to understand uninsured motorist rates in Florida better.

Benefits of Uninsured Motorist Coverage

Uninsured motorist coverage is a big help for drivers in Florida. It gives peace of mind by protecting against financial losses from accidents with uninsured drivers. This coverage is like a safety net, helping people recover without worrying about huge medical bills.

This coverage is great because it covers medical costs and lost wages. If someone hits you and doesn’t have insurance, you can still get paid for your injuries. It helps cover unexpected medical bills and treatment costs.

It also makes recovering from an accident easier. With UM coverage, dealing with insurance claims is simpler, especially in a complex world. This is very helpful during tough times.

- Peace of mind knowing you’re protected from uninsured drivers

- Coverage of medical expenses and lost wages

- Easy recovery process when the at-fault driver is uninsured

Overall, UM coverage greatly improves the financial safety for drivers. It makes driving in Florida safer.

Conclusion

Uninsured motorist coverage is key to protecting drivers from accidents with uninsured motorists. In Florida, where more drivers lack insurance, UM coverage is vital. It covers medical bills and repairs, giving drivers peace of mind on the road.

Knowing how UM coverage works helps Florida drivers make smart choices about their insurance. Working with insurance agents to tailor coverage can make drivers and passengers safer. This way, they’re ready for any road surprises.

Choosing UM coverage is a smart move for safety and financial security. It lets Florida drivers travel with confidence, knowing they’re ready for anything unexpected.

Read more:Capital One Auto Finance

FAQ

What is Uninsured Motorist Coverage?

Uninsured Motorist (UM) Coverage helps drivers who get into accidents with those who don’t have insurance. It pays for medical bills, lost wages, and other costs from these accidents.

Why is UM Coverage important in Florida?

Florida has a lot of drivers without insurance, about 20%. UM Coverage is key to making sure drivers get the help they need after accidents with these uninsured drivers.

What should I do if I am in a hit-and-run accident?

Stay calm and keep everyone safe if you’re in a hit-and-run. Call 911, document what happened, and tell your insurance about it if you have UM Coverage. This can help cover your medical and repair costs.

What types of Uninsured Motorist Coverage are available?

Florida offers two main types of UM Coverage. One covers injuries from accidents, and the other covers damage to your car.

How does Underinsured Motorist Coverage differ from Uninsured Motorist Coverage?

Underinsured Motorist Coverage helps when the other driver’s insurance doesn’t cover your costs. Uninsured Motorist Coverage kicks in when the other driver has no insurance.

What are the insurance policy limits for Uninsured Motorist Coverage in Florida?

Florida doesn’t require specific UM Coverage limits. But, insurance companies must offer coverage that matches the driver’s liability limits. Common limits are $10,000, $25,000, and $50,000.

What is the process for filing an Uninsured Motorist claim?

To file a UM claim, first document the accident well. Then, tell your insurance right away. Provide police reports and medical records as evidence for your claim.

What factors influence the cost of Uninsured Motorist Coverage in Florida?

UM Coverage costs can change based on your age, driving history, coverage limits, where you live, and the insurance company’s pricing. This includes your credit score and past claims.

What are the primary benefits of Uninsured Motorist Coverage?

UM Coverage offers financial protection against uninsured drivers. It helps with medical bills and lost wages. It also gives you peace of mind knowing you’re covered if you have an accident with an uninsured driver.